38+ calculate mortgage interest deduction

If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Doc A Third Critique Of Neo Liberalism A Manifest Of Covert And Overt Concepts For The Existential Re Construction Of The Political Economy Noel Tointon Academia Edu

Well Talk You Through Your Options.

. Divide line 11 by line 12. If your home was purchased before Dec. Web Here is an example of what will be the scenario to some people.

You paid 4800 in. Please note that if your. The terms of the loan are the same as for other 20-year loans offered in your area.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket. Web Mortgage interest deduction limit.

Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms. Visit PIMCO Today For Actionable Investing Ideas. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply.

So the total Interest that is. Publication 936 explains the general rules for. Web Since 2017 if you take the standard deduction you cannot deduct mortgage interest.

Refinance Your FHA Loan Today With Quicken Loans. Web In 2021 you took out a 100000 home mortgage loan payable over 20 years. Web March 4 2022 439 pm ET.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage. X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured. Homeowners who bought houses before.

You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt. Calculate Your Monthly Payment Now. Ad Refinance Your House Today.

Discover Helpful Information And Resources On Taxes From AARP. Web Total amount of interest that you paid on the loans from line 12 not reported on form 1098. Multiply line 13 by the decimal.

Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Calculate Interest payment as shown below.

Web Used to buy build or improve your main or second home and. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. Secured by that home.

For the 2020 tax year the standard deduction is 24800 for. Ad Is Your Portfolio Positioning Ready For Changing Interest Rates. Web Answer a few questions to get started.

Scientific Bulletin

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Tax Calculator Nerdwallet

Mortgage Interest Tax Deduction What You Need To Know

Mortgage Payment Tax Calculator Deduction Calculator

Mortgage Interest Deduction Tax Calculator Nerdwallet

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Keep The Mortgage For The Home Mortgage Interest Deduction

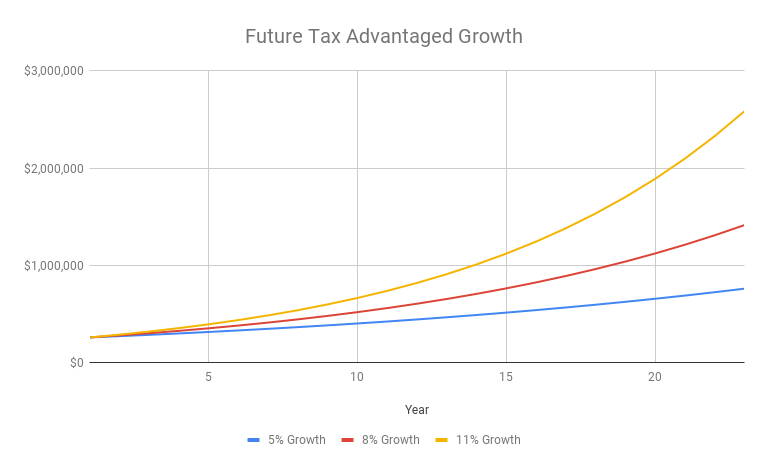

Why You Should Max Out Your 401 K In Your 30s

Free 38 Sample Estimate Forms In Pdf Ms Word

Mortgage Interest Deduction Changes In 2018

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Tax Deduction Calculator Freeandclear

2021 Tax Planning Avoiding Capital Gains Tax In Retirement With Taxcaster

Free 65 Loan Agreement Form Example In Pdf Ms Word

Home Mortgage Interest Deduction Calculator

Home Mortgage Interest Deduction Deducting Home Mortgage Interest